Filet is a decentralized Filecoin staking platform that helps bridge the gap between FIL holders and Filecoin mining through its FIL staking service. It has been steadily operating for nearly two years and has seen a total of 510,000 FIL staked, generating returns of over 100,000 FIL for Filecoin stakers. Additionally, its 510,000 FIL has increased the computing power of storage providers by around 85 PiB, thus promoting the development of the Filecoin storage provider ecosystem.

With the launch of Filecoin’s FVM, staking applications will become feasible, providing great development opportunities for storage providers who need FIL tokens to scale up their business. However, creating a DApp can also be challenging.

To tackle these issues, Filet will be fully upgraded to support FVM, providing SaaS services that enable storage providers to easily build staking DApps with just one click. This will allow them to deploy their own DeFi applications quickly and provide staking services to their customers. Additionally, the Filet platform will offer lending services based on smart contracts, IT, and other services to more compliant storage providers, such as staking and lending.

To get a better grasp of Filet, we will introduce it from four aspects:

- Opportunities for Filecoin Holders

- Opportunities for Storage providers

- Platform Openness

- Filet DAO

Opportunities for Filecoin Holders

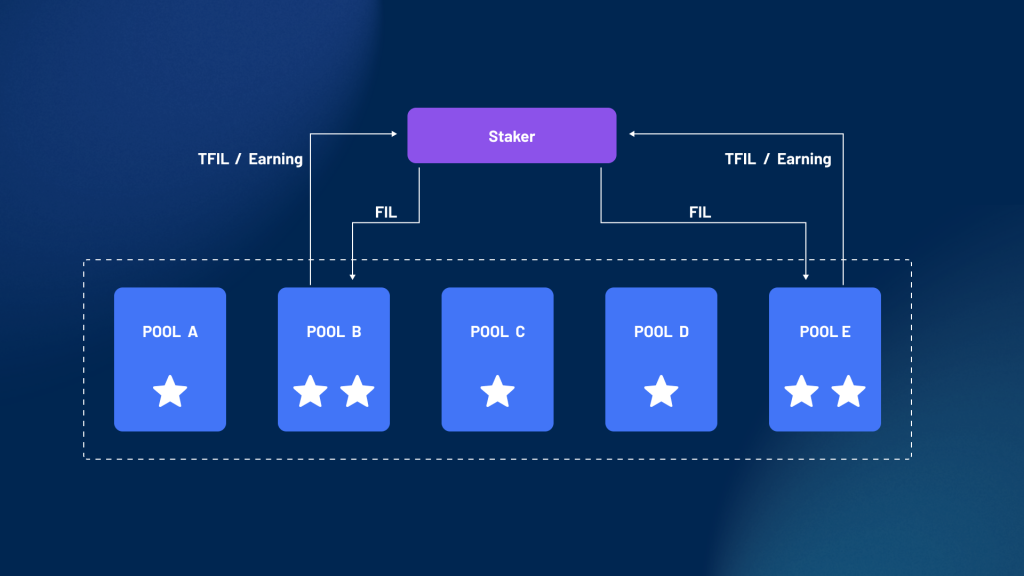

On the Filet platform, storage providers have created a variety of different staking pools to attract different FIL holders to stake.

For FIL holders, the platform offers a variety of options to choose a staking pool based on different parameters, such as the pool owner, staking period, rate of return, and more.

Furthermore, the platform also provides a convenient one-click staking function that pledges the user’s assets to the top-ranked SP’s staking pool via a contract, streamlining the user staking process.

FIL holders can stake FIL to different pools to obtain corresponding computing power and tFIL pledge certificates. tFIL and FIL have a 1:1 exchange rate, and users must return tFIL to redeem FIL. Pools can opt to set aside a portion of their total assets as an “Exit Liquidity Reserve” to facilitate exits more efficiently.

Each pool distributes the day’s income proportionally to the computing power held by users.

Rating system

On the Filet platform, each staking pool is tied to a different storage provider, so the risks and rewards of each pool vary. To help FIL holders make better decisions when choosing a staking pool, the platform provides a rating system that evaluates each pool based on factors such as open permissions, storage capacity, and past performance. This system allows FIL holders to view the score ranking of each staking pool to make an informed decision.

For instance, a staking pool might lend FIL to riskier storage providers for higher yields. However, such actions may raise the risk score of a staking pool, thus affecting its ranking and attractiveness. Consequently, the rating system not only helps FIL holders make informed decisions but also encourages staking pool managers to practice risk management more cautiously.

nFIL

As a proof of equity on the Filet platform, nFIL provides more opportunities and choices for FIL holders. It can be used as collateral for borrowing, thus bringing more value to the holder.

Furthermore, the use of nFIL will increase the confidence and interests of FIL holders and further spur the circulation and utilization of FIL. As an integral part of the platform ecosystem, nFIL will continue to play a pivotal role in the future, aiding the growth of the Filet platform and the entire Filecoin ecosystem.

Opportunities for Storage Providers

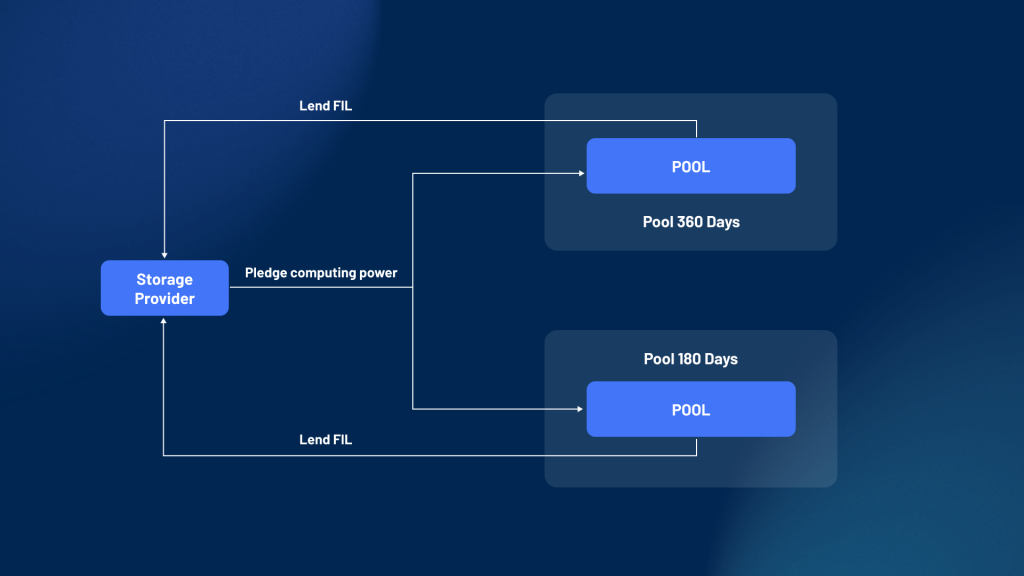

Filet provides two development solutions:

Firstly, storage providers can directly join the Filet platform, create a corresponding pool, and pledge computing power to the platform to borrow the FIL staked by users.

How does it work?

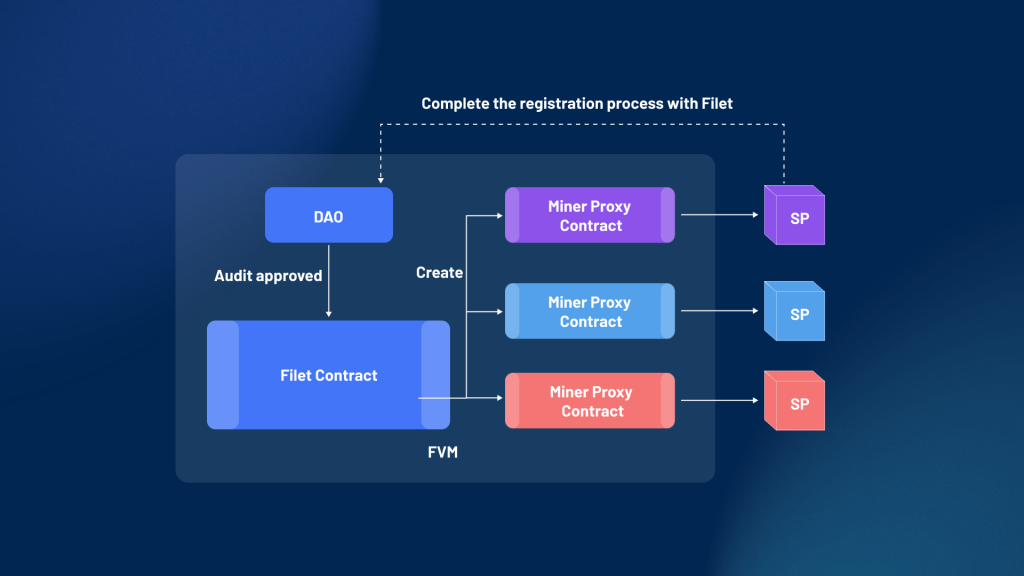

- Storage providers can apply to join the Filecoin platform, and their application needs to be approved by a DAO.

- If approved, the platform will create the Miner proxy contract for the provider and transfer the ownership of one or more Filecoin Miner Actors to the Miner proxy contract.

- Based on the Filet contract of the Filet platform (term, interest rate, collateral requirements), a corresponding staking pool is created, allowing users to stake FIL to obtain computing power.

Contract introduction

The Filet platform is mainly composed of three contracts in the early stage: the Miner proxy contract, the Filet contract, and the DAO contract.

✔The Miner Proxy Contract

The Miner proxy contract is controlled by three parties: storage providers, the Filet DAO community, and Filecoin team or an invited third party with credibility. When two of the three parties agree to initiate an operation request, the contract will execute the request. This tripartite control design can ensure the fairness and transparency of the management contract.

The Miner proxy contract can strictly monitor and restrict the operation, fund use, and lending behaviors of SPs on the chain.

✔The Filet Contract

The Filet contract is responsible for the main logic and calculation rules of staking, such as the staked token, staking period, yield rate, etc. At the same time, the Filet contract will also generate a corresponding Miner proxy contract based on the approved SP and perform necessary authorization and management. The Miner proxy contract will be used to manage the computing power and revenue of providers.

✔The DAO Contract

The DAO contract is used to manage and execute DAO decisions and operations.

Distribution of profits and penalties

The Miner proxy contract is a key component of the Filet platform, which transfers user earnings and due principal to the platform account. The platform will automatically calculate the total earnings due to the users.

In the event of insufficient earnings provided to users or any other abnormal situation, Filet will automatically freeze all assets of the mining pool through the proxy contract and suspend the distribution of earnings to users of the mining pool. The mining pool has 7 days to make up the corresponding amount to unfreeze the assets and resume services to users. However, if there is no response from the mining pool, Filet DAO will work with the Filecoin team to terminate the miner’s sector, in order to return most of the pledged tokens and minimize user losses.

Through such a proxy contract, Filet can protect the rights and interests of users while encouraging the integrity of mining pools. It will ensure the reliability and stability of the platform, contributing to the growth and success of the entire ecosystem.

Secondly, SP’s can use Filet’s SaaS service to set up its own branded staking platform.

SPs can use the functions and services of the Filecoin SaaS platform to construct their own bespoke staking platform. These platforms can be tailored according to their needs, such as names, logos, website designs, and staking pool settings. In this way, SPs can improve their own brand and image while attracting more users.

If the staking platform of its own brand is operating optimally, it can be considered for inclusion into the network of other SPs. This will bring more traffic, and further, enhance the influence and competitiveness of the platform.

Through the Filet SaaS platform, global SPs and FIL holders can be gathered to provide support and aid for the growth of the entire industry. This platform will serve as a bridge between SPs and FIL holders, enabling them to interact and cooperate more effectively.

Filecoin holders can choose the optimal staking option through the staking pool on the platform to obtain more earnings. The platform also provides opportunities for FIL holders to vote, make decisions, and govern, allowing them to participate in the construction and development of the entire ecosystem.

Platform Openness

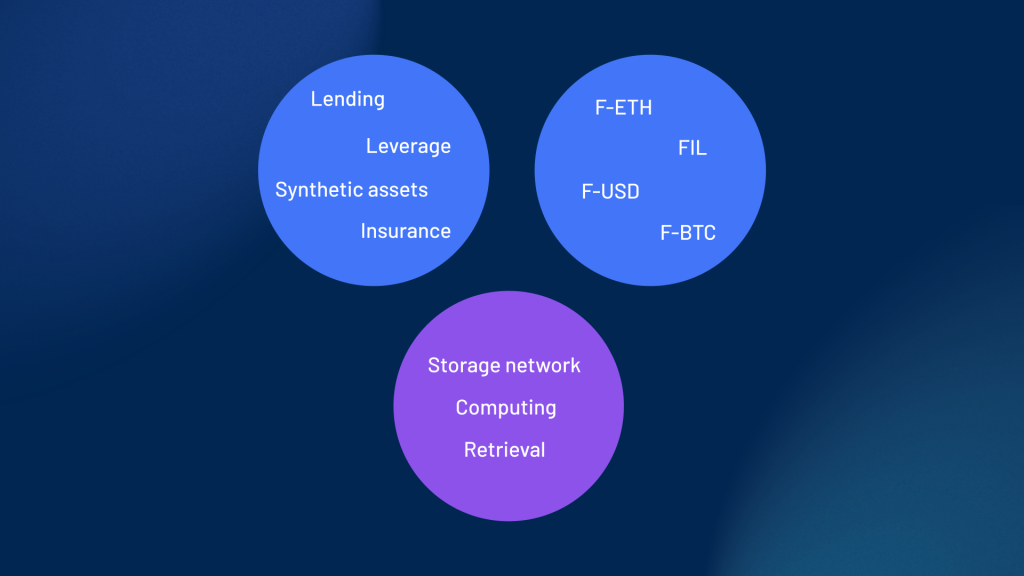

The Filet protocol remains relatively open, allowing for the development of more applications based on its protocol.

Filet DAO

To promote democratized financial decision-making and community governance, Filet will set up a DAO to make Filet a leader in the DeFi industry and provide users with the finest financial services.

Filet 2.0 Video Demo

Here is a video demo about how Filet 2.0 works:

About Filet

Filet is a Filecoin mining power tokenization protocol that deployed on Filecoin and BSC networks. It tokenizes Filecoin mining power and introduces it into the DeFi ecosystem to provide FIL holders with high-growth FIL staking services. The mining power and assets are completely open and transparent.

Filet is backed by one of the largest storage providers in North America. The project is open source and audited by Certik.

Webiste: www.filet.finance

Telegram: t.me/filet_finance

Twitter: @Filet_finance

Medium: https://filet.medium.com/

Email: contact@filet.finance