Since the beginning of 2022, the crypto asset market has been in a downturn, with a total market value of around US$1.91 trillion, 34% less than the historical high of US$2.92 trillion in 2021. The total value of the ecosystems on the chains is also reducing. According to DeFi Pulse data, the total value of locked encrypted assets (TVL) on Ethereum, the largest on-chain ecosystem, is US$78.4 billion, there is a drop of nearly 30%compared with the peak of US$110 billion in 2021.

The general feeling of crypto asset holders is that the market is going down, and how to safely reduce asset loss in the downturn has become many people’s essential demand. In this scenario, the TVL of cryptocurrency products with stable returns has grown against the downward trend and has become a new choice for many cryptocurrency holders.

In June last year, Compound Labs, the company behind the DeFi lending protocol Compound, established Compound Treasury, a new product for enterprises and institutions. It cooperates with Fireblocks and Circle and allows non-encrypted enterprises and financial institutions such as banks and fintech companies, as well as large USD holders to exchange USD for USDC and get a 4% of fixed interest rate.

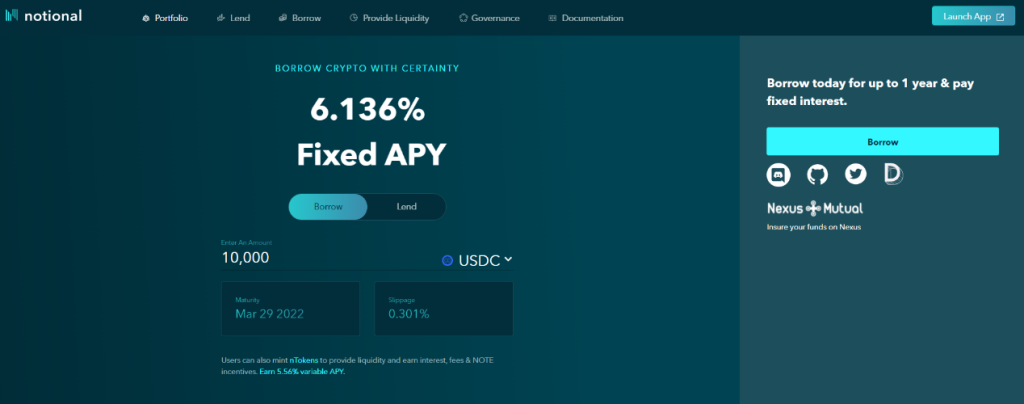

Moreover, the zero-coupon bond platform Notional, the principal and interest rate separated application Element, the stable currency bank application Anchor, and the structured risk management platform BainBrige have all designed various operating mechanisms and launched fixed-income products.

In the bear market, such products are favored by some people, but the less than ten percent fixed annualized income is obviously not attractive enough for cryptocurrency holders who are used to hundreds or even thousands of times of return.

So DeFi-like projects like Filet have become the choice of more people. First, the income on Filet is much higher than that of those fixed-income products. The underlying logic of Filet is Filecoin mining, and users get FIL as income. If FIL rises sharply in the future, the income is likely to double. This, to a certain extent, satisfies users’ expectations in the cryptocurrency market of pursuing higher returns.

Cryptocurrency products with stable returns can minimize the risks. They can not only serve as a safe place for cryptocurrency holders in bear markets but also provide an investment opportunity for traditional financial users. In the future, stable income cryptocurrency products may become an important channel for traditional institutions to enter the crypto asset market and even the field of DeFi.